Employment-Based Fifth Category Visa or EB5 Visa was introduced by the United States Congress in 1990. The EB5 Visa category was formed to grant U.S. immigration benefits to foreign investors seeking U.S. permanent residence by making an investment in the United States.

The EB5 visa program was formed with the aim of attracting foreign direct investment and creating American jobs. 10,000 immigrant visas are allocated annually for foreign investors and their immediate family members. EB-5 Visa is a direct and predictable path to obtaining US Permanent Residence (Green Card) and US citizenship in the future.

By investing in the U.S., foreign nationals can secure a stable future for themselves and their families.

Direct investment through the EB-5 program involves investing the required capital (currently $800,000 in a Targeted Employment Area or $1,050,000 elsewhere) into a new commercial enterprise that the investor manages or actively participates in.

This approach requires the business to directly create 10 full-time jobs for U.S. workers within a specified timeframe, meeting the program’s job creation requirements.

Benefits

Greater Control

Investors have full control over their business, allowing them to align the investment with their interests and expertise.

Potential for Higher Returns

Since the investor directly owns the business, they can benefit from its success and profitability.

Hands-On Involvement

Ideal for experienced entrepreneurs, this option allows for active management and oversight.

Streamlined Investment Structure

Direct investments typically involve fewer intermediaries, reducing dependency on third-party management.

Drawbacks

Job Creation Responsibility

Investors must directly create 10 full-time jobs, which can be challenging in certain industries or economic climates.

Higher Risk

Business failure could jeopardize the investor’s immigration process and financial investment.

Operational Complexity

Managing a business in a new country involves navigating regulatory, cultural, and operational challenges.

No Pooled Resources

Unlike investments through Regional Centers, direct investments lack the shared risk and support of pooled investment projects.

Regional Center investments allow EB-5 investors to contribute their capital to a project managed by a USCIS-designated Regional Center. These centers focus on economic development within a specific geographic area and facilitate projects that meet EB-5 requirements, such as real estate developments or infrastructure improvements.

Unlike direct investments, Regional Center projects use an indirect job creation model, allowing the use of economic impact analyses to count jobs created indirectly or induced by the investment.

Benefits

Reduced Job Creation Burden

Regional Centers use indirect job creation, simplifying the process of meeting the 10-job requirement.

Passive Investment

Investors do not need to manage the day-to-day operations of the project, making it ideal for those seeking a hands-off approach.

Expertise and Support

Regional Centers provide professional project management, reducing the need for investors to navigate regulatory complexities alone.

Diversified Risk

Pooled investments in large-scale projects often spread risk across multiple investors and sectors.

Established Track Record

Many Regional Centers have a history of successful projects and EB-5 approvals, offering added assurance.

Drawbacks

Limited Control

Investors have minimal or no direct influence over the management or decision-making of the project.

Dependency on Regional Center Performance

A poorly managed Regional Center or project could jeopardize the investment and immigration process.

Lower Potential Returns

Regional Center projects typically offer modest returns compared to direct investments, as they prioritize job creation over profitability.

Fees and Costs

Regional Center investments often involve additional administrative and management fees.

Indirect Risks

Job creation metrics rely on economic modeling, which can be complex and subject to scrutiny by USCIS.

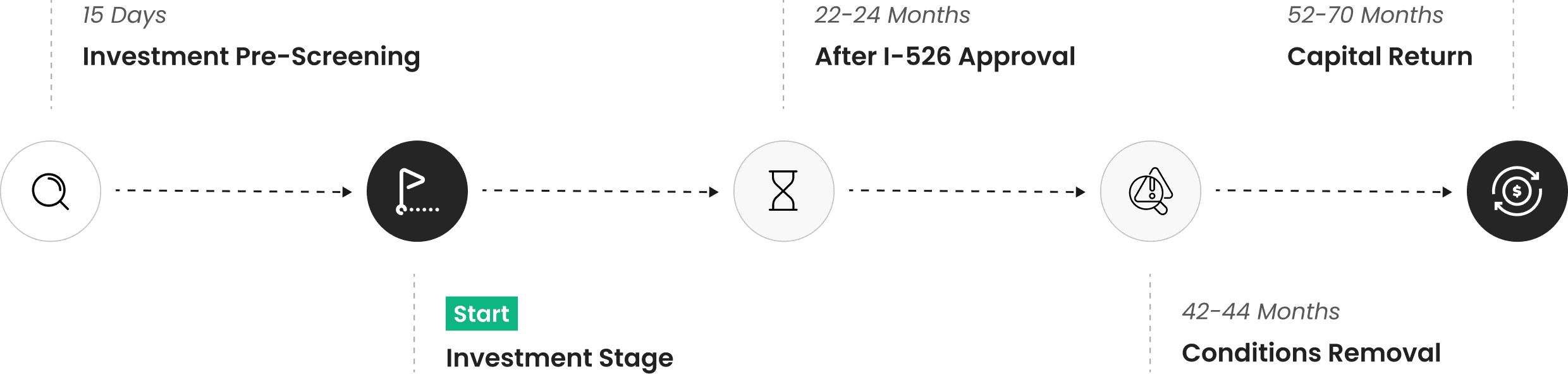

The EB-5 Visa involves several stages, beginning with the investor making a qualifying investment and filing a petition (Form I-526E) with USCIS to apply for a Conditional Green Card. If the application is approved, the investor and their qualifying dependents (spouse and unmarried children under 21) receive a Conditional Green Card through either a Consular Interview or Adjustment of Status.

Once the Conditional Green Card is issued, the investor must file a Petition to Remove Conditions (Form I-829) between 1 year and 9 months and 2 years after receiving the Conditional Green Card. This petition demonstrates compliance with EB-5 requirements, including the creation of 10 new full-time American jobs per investor.

The EB-5 Reform and Integrity Act of 2022 introduced changes to the timeline for capital repayment. Previously, EB-5 investors could only be repaid after the 2-year sustainment period following the issuance of the Conditional Green Card. However, as of October 2023, USCIS clarified that the 2-year sustainment period begins when the funds are deployed into the Job-Creating Entity or Project, not when the Conditional Green Card is issued. Most projects are now structured to return capital within 5 years from the initial investment.

If USCIS determines that the investment successfully created the required jobs, the investor and their dependents are issued an Unconditional Green Card, granting permanent residency in the United States.

Disclaimer

The timeline provided is for general informational purposes. Please Contact Us for a detailed and project-specific timeline.

The EB-5 visa offers a path to U.S. residency for investors who meet the following financial and job creation requirements.

Investment Requirements

To qualify for the EB-5 visa, you need to make one of the following investments:

$800,000 in a Targeted Employment Area (TEA) (high unemployment or rural areas).

$1,050,000 in a non-TEA (areas outside TEAs).

Creation of 10 Full-Time Jobs

The investment must result in the creation or preservation of 10 full-time jobs for U.S. workers. These jobs can be directly created by the business (for direct investments) or indirectly through the economic impact of the project (for Regional Center investments).

Lawful Source of Funds

The investor must prove that the invested capital comes from a lawful source through documentation, such as tax returns, business records, or asset sales.

At-Risk Investment

The investment must be at-risk, meaning there is no guarantee of return, as the funds must be fully committed to the project to stimulate economic growth.

Sustained Investment

The Investment must remain invested for at least 2 years (Sustainment Period) after deploying into a qualified job creating project.

The EB-5 Reform and Integrity Act (RIA) of March 2022 revamped the EB-5 Visa program by establishing three set-aside categories: rural, high unemployment, and infrastructure projects.

These Targeted Employment Areas (TEAs) aim to attract foreign investments to underserved regions, enhancing economic growth and job creation. This is particularly beneficial for applicants from countries with high demand, like India and China, who often face longer wait times for green cards.

Rural TEA

Projects in areas with fewer than 20,000 residents, outside major metropolitan areas.

High Unemployment TEA

Projects in areas with unemployment rates 150% or more than the national average.

Infrastructure Projects

Government-administered projects focused on public works, such as transportation and utilities.

The RIA allocates 20% of EB-5 visas for rural projects, 10% for high unemployment, and 2% for infrastructure, providing unique investment opportunities.